Why do I need a Will?

Your Will is an opportunity for you to have your say about what happens with your assets after you have passed away. A Will can be very flexible – appointing up to 4 Executors to manage and administer the Estate, and leaving general or specific gifts to nominated beneficiaries. It can also be more prescriptive, as there are many people who make the most of the opportunity to 'rule from the grave'. It is important to discuss your objectives with a qualified legal professional, who can explain the pros and cons of the different styles of Will, the practicalities in administering your Estate after you are gone, and to ensure that your objectives have legal effect.

I don't have any assets – do I still need a Will?

It's always a good idea to have a Will in place. Your Will can identify who you would like to be in control of what happens after you've passed away – for example, organising a funeral, whether you are cremated or buried, and what is written on the plaque or headstone. These types of decisions can often be the cause of conflict between loved ones, and it can be helpful to nominate the person (your Executor) who is entitled to make these decisions. Similarly, if you have a Will in place, your Executor has control over what happens with your personal items, including photographs and other sentimental items.

Also, often even if people don't have many assets, they may still have a superannuation fund which includes a default death benefit payment. If you haven't nominated a (valid) beneficiary for those death benefits, they pass to your Estate. Without a Will, the default legal position applies – see 'No Will, No Say … a Guide to Victoria's Intestacy Provisions' for more information.

The thought of making a Will seems overwhelming – is it complicated?

Most of our clients comment that making their Will was much easier than they had expected it to be. Using an analogy, if you think your car may need to be serviced but you don't know anything about mechanics, it would be quite a feat for you to know what to look for, and how to fix anything that had gone wrong. However, auto mechanics service and repair vehicles every day, and all you need to do is drop your car in and leave them to it. Similarly, our experienced Wills & Estates team are specialised in the preparation of Wills. All we need from you is an outline of what you would like to happen after your passing, and the information about your family circumstances and asset holdings, and we can do the rest.

Who should I appoint as my Executor?

Your Executor is the person (or people) who are responsible for identifying your assets and making distributions in accordance with your Will.

You may nominate up to 4 people at a time to be your Executors, however fewer people is easier from a practical perspective. You may also nominate your Executors in a successive manner – that is, I appoint A, and if not A, then B and C.

It is really important to consider any potential conflicts or issues which may arise in the course of the administration of your Estate, and how well the beneficiaries get along with one another.

A beneficiary can be an Executor, and in straightforward family situations, it may be preferable to keep the Executors and beneficiaries consistent. This has the effect of ensuring that the Executor is acting in the best interests of the beneficiaries because they are one and the same.

Where there are concerns about potential conflicts, or particular complexities, a trusted friend or advisor, or a professional (such as an accountant, lawyer or trustee company) may be worth considering. It is important to note that any Executor (whether a professional or a friend) may be entitled to seek remuneration for the work undertaken as part of this role. This may be sought either through:

1. Explicit provision in the Will;

2. Agreement between all of the beneficiaries; or

3. An Order of the Court;

and may be up to 5% of the total value of the Estate, depending on the value of the Estate and the amount of work involved.

Can an Executor named in a Will get paid in Victoria?

Executors are entitled to be reimbursed for the reasonable expenses they incur, but in general they are not allowed to be paid for the time they spend in the role, unless:

1. There is provision in the Will allowing for the payment of the Executor; or

2. All of the beneficiaries of the Estate agree to the payment; or

3. The Court agrees to the payment, on the basis of the Executor Commission provisions of section 65 the Administration and Probate Act 1958 (Vic).

It is important to note that this provision allows for up to 5% of the assets to be paid to the Executor as commission, although the award may be less than this, depending on the work involved in the administration of the Estate.

What is the difference between an Executor Power of Attorney?

An Executor is the person (or people) you have named in your Will to manage your Estate after you have died. They do not have any power to act while you are still alive, as the Will does not take effect until the death of the testator.

An attorney nominated under Power of Attorney is generally appointed to act on your behalf while you're still alive. These are most commonly put in place to enable someone to make decisions for you in case you lose capacity in the future. Subject to limitations you may wish to write into the document, an attorney under a Power of Attorney can do anything on your behalf that you can do for yourself or, if you've lost capacity: that you could do for yourself if you still had the capacity. However, as a person who has passed away can't do anything, this power stops when that happens, and the Executor takes over.

Many people choose the same person(s)as their attorney(s) under Powers of Attorney and as Executor(s) under their Will to ensure a smooth handover between incapacity and death, however, this is not essential.

How much does it cost to have a Will prepared?

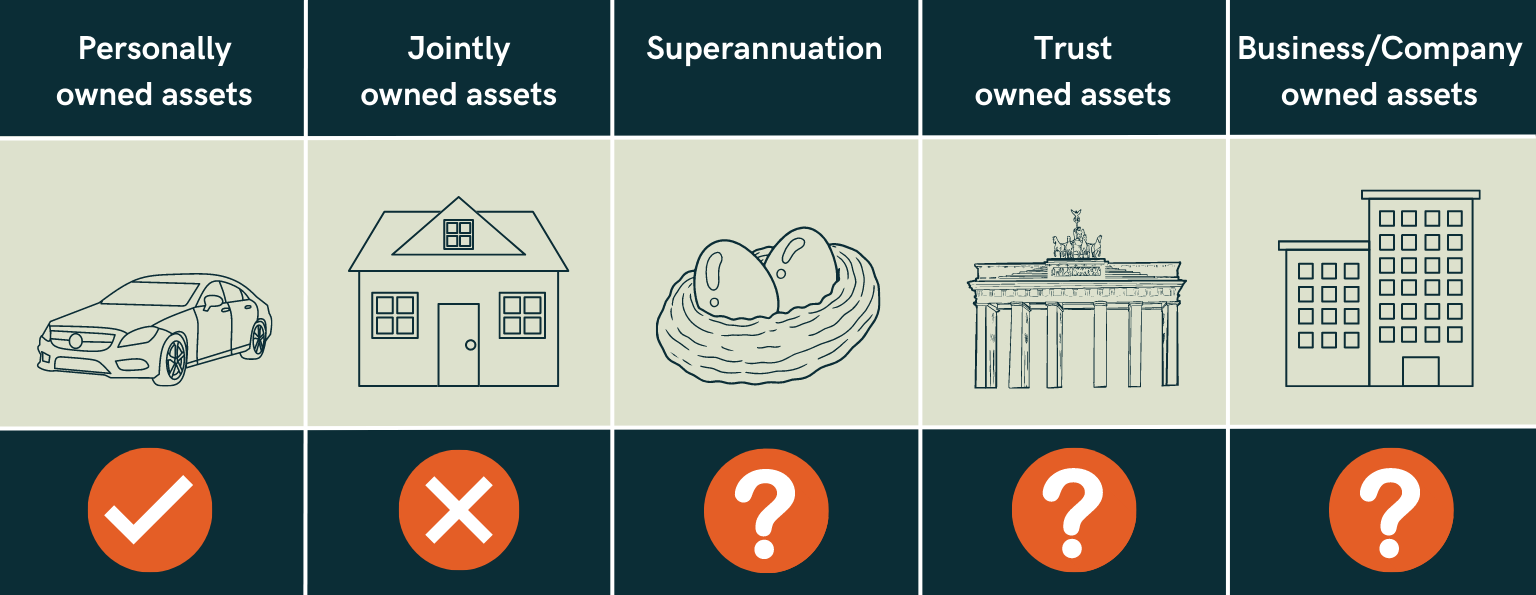

The cost to have a Will prepared by a legal professional depends on the complexity of your personal situation, as well as the structure of your ownership. When you are discussing your Will with a lawyer, the lawyer should consider whether the asset forms part of your Estate to be covered by your Will, and whether there are any supplementary documents which need to be reviewed or prepared. For example, in general, jointly owned assets, superannuation, and assets held within trusts or private companies will not form part of your Estate and are not covered by your Will. 'Estate Planning' is the term used to ensure that your asset structure is properly identified, and your objectives can be fulfilled within your Will and any relevant supplementary documents.

Contact us today on + 61 3 9822 8588 and we can prepare a cost agreement for your consideration.

Can I write my Will myself? Why can't I use a DIY Will Kit?

You can prepare your own Will, or get a Will Kit online or from the Post Office. However, we all too often see issues after a person has died caused by 'homemade' Wills. The issue may be that the Will was not signed properly, or there is ambiguity in the language used, or that the assets being 'given' in the Will are actually not part of the person's Estate. Discussing your Will with an experienced legal professional ensures that your estate planning is more likely to be effective, and you may find there are options available to you that you were unaware of. A lawyer will consider how your assets are held, and whether they are covered by your Will, and if not, may advise on how you can still achieve your objectives with supplementary documents or restructuring during your lifetime.

What Assets May Not Be Covered By My Will?

It is important to discuss this with a professional (like us!), as some assets (and liabilities) may or may not be covered by your Will, and we can determine this by reviewing your particular structures and circumstances.

In general:

What Testamentary Capacity is required to make a Will?

Anyone can make or change their Will provided they understand:

a) what a Will is (i.e. a document setting out what is to happen to their property when they die);

b) what the Will is likely to cover (that is, the general value and type of asset);

c) the effect of the Will they are putting in place; and

d) the people who may reasonably consider themselves entitled to benefit from the Will, and any issue which may be likely to arise as a result of the Will.

A medical opinion should be obtained from the person’s treating medical practitioner explaining that the will maker has the required testamentary capacity to make a will, particularly if:

a) the person making the Will is over 80 years of age;

b) the person making the Will has health concerns or takes regular medication which may impact decision making;

c) there may be a challenge to the Will; or

d) if there are any other concerns that may arise, or reasons capacity may be questioned after the person's death.

I don't want my Will to be challenged – if I give $1, does that prevent them from challenging my Will?

In short, No. Different jurisdictions (various countries and States) have their own rules about who is eligible to challenge a Will. In Victoria, in general a Will can be challenged by a domestic partner, child, financial dependent or member of your household if they consider that you have not provided them with enough financial support from your Estate.

Whether or not a person is eligible to challenge your Will is based on the laws of the relevant jurisdiction, and it is worthwhile checking with a qualified legal professional to confirm who these people may be in light of your specific personal circumstances.

If someone is eligible, there are a number of factors to consider in relation to their likely success, such as the value of the Estate, their financial need, your relationship with them, and the competing needs of other beneficiaries of your Will.

If my Will can be challenged, what's the point of making one?

In some cases, careful estate planning, in consultation with a specialist, can minimise the risk of a challenge, so discussing your objectives and concerns with a legal professional may be helpful.

Even where the risks cannot be completely mitigated, it is still important to put a Will in place. Without a Will, your assets will be distributed in accordance with the intestacy provisions which are unlikely to be consistent with your objectives if you are concerned about a possible challenge. If you have a Will in place, the gifts you have outlined will take place unless:

a) There is a challenge; and

b) The challenge is

Although challenges are often talked about, they are actually relatively uncommon, and in the large majority of cases, the Will is administered without a challenge.

If there is a challenge, the Will is the 'starting point' for negotiations. The Courts do acknowledge 'freedom of testation' -that people should generally have the right to decide how their assets are distributed upon their death – and this is interfered with only when cause is shown.

What if I'm living in a de facto relationship and I die without a Will?

If your partner can satisfy the legal requirements proving the relationship, they may be entitled to share in your estate on your death. The necessity of proving the relationship can result in additional expense and distress at a time when they are grieving. It is much easier to draft a Will naming your partner as a beneficiary.

How often should I update my will?

Your Will expresses your wishes at a particular point in your life. It is advisable to regularly review your Will as your circumstances change so that it reflects your current wishes.

Situations we recommend updating your Will:

- Marriage

- Separation and or divorce

- Starting a de facto relationship

- Death of a spouse

- Having children or grandchildren

- Your children having remarried or divorced and have extended families

- The executor named in the Will, having become ill, is unable to handle the responsibility, or has died

- A beneficiary named in the Will having died

- Retirement often results in people restructuring their affairs. This is an ideal time to be proactive in your estate

- When you buy or sell assets. There are many examples of people bequeathing assets which they sold before they This resulted in some beneficiaries receiving nothing, while others received significantly more than was intended in the original Will.

We recommend that you review your Will at least every five years or, earlier, if you have significant changes to your circumstances (such as marriage, death, estrangement, divorce or children).

Does getting married or divorced affect my Will?

If you marry after you have made a Will, the Will is generally revoked, unless it was made in anticipation of marriage. Marriage will not affect a gift to the person who is your spouse at your date of death. If you divorce after you make your Will, it only revokes or cancels any gift to a former spouse.

If I own assets overseas do I need to make a separate Will?

If you own assets of financial value overseas we recommend you make a separate Will dealing with those assets, rather than having one Will expressed to deal with all assets.

The inheritance laws in other countries may be significantly different to those in Australia. Some countries have laws that result in certain family members being automatically entitled to a specified share in your estate regardless of the terms of your Will.

There may be laws regarding who may contest your Will and taxation laws that may impact your estate and your beneficiaries. There may even be different requirements for the execution of a valid Will.

In 2015 Australia became a signatory to an International Convention in relation to international wills. Not all countries are signed up to the Convention, but for those countries that have signed up, there is a standard form of Will that will be accepted as a validly executed Will. However, the law in each country still applies in respect of the administration of the estate and so issues may still apply.

If you need assistance and support with your Will, Estate Planning, Probate or an Estate Dispute our Wills and Estates lawyers are here to help. Contact us today on + 61 3 9822 8588.